Withholding Tax Statement (tax-income certificate)

2022.12.21

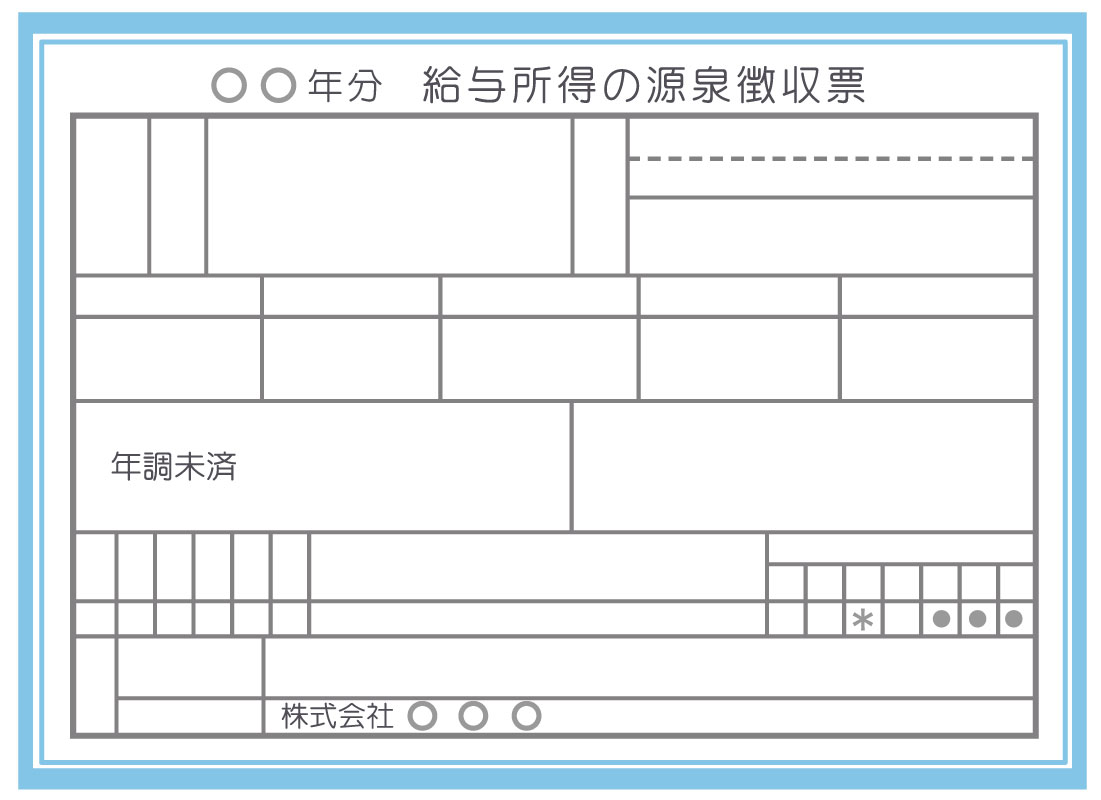

You will receive a Withholding Tax Statement (so called Gensen Choshu Hyo) on December every year. Let’s understand what is written and make sure if the information is correct.

What is withholding tax statement?

A withholding tax statement is an official document that shows your total salary in a year (from January 1st to December 31st). The company where you are working at will issue and provide the document to you.

- What you need to understand about income tax

Income tax is not directly calculated based on your total income (something like “XX% of total income”). The calculation will take your personal situation into consideration, such as “Whether you have family members” or “Whether your family members have income”. After a certain amount of deduction is applied upon your total income, a designated amount of percentage is calculated and then your income tax is fixed. This deduction is called “Koujo”.

When you receive a withholding tax statement

Your company will provide it to you on December every year. If you leave the company during the year, you receive the document within a month after you leave there.

Main information written on the withholding tax statement

- Total salary in a year

It is your salary from January 1st to December 31st including your monthly salary, over time pay, bonus, position allowance, etc. Commuting expenses are not included.

- Amount after deducting “Employment income deduction”(①)

It is the amount which “Employment income deduction (a kind of deduction which differs depending on your income)” is subtracted from your total salary in a year.

- Total amount of deduction from income(②)

The amount differs depending on your personal situation. For example, there are “deductions of social insurance premium (health insurance, welfare pension and employment insurance)”, “deductions of life insurance premium”, “exemption for spouses” and “exemption for dependents (such as children under 16 years old)”.

- Withholding income tax amount

It is the amount of income tax you have paid in the year. The calculation is made upon your “taxable income (the amount after subtracting ② from ①). Different percentage and amount of deduction will be applied to the calculation.

When you need a withholding tax statement

- You will need to submit it when you file your tax returns.

For tax return, please refer to the page below.

https://social-b.net/baiyu/en/national-tax0813/

- When you change jobs

In order to tell your total salary in a year until the timing of changing jobs, you will have to submit your withholding tax statement to your new company.

What you need to check

- A withholding tax statement includes your personal information including the name and number of your dependents such as your spouse or children. If any information is wrong, you have to talk to your company.

- It is compulsory for your company to issue a withholding tax statement to you as long as you are employed by the company and you have income from there. If you do not receive it, you have to ask your company to issue it.

- Please also refer to the following pages.

“Words used in Payment Slip (Kyuyo meisai)”

https://social-b.net/baiyu/en/payment-slip20020611en/

“About pension system in Japan”

https://social-b.net/baiyu/en/pension20220214en/

“National tax” https://social-b.net/baiyu/en/national-tax0813/

- If you have further inquiries, please feel free to ask questions from the link below.

https://social-b.net/baiyu/en/question-box/