About pension system in Japan

2022.02.14

↑↑

This is examples of letters from Japan Pension Service. If you receive any of them, please check what is written. Today let’s learn about pension systems in Japan.

What is pension system in Japan (public pension system) like?

- Pension system is that you will receive payments from the government after reaching 65 years old. Other than that, you will be able to receive pension if you become disabled by an accident or a disease, or if your family member passes away and it causes you to have unexpected financial difficulties. In order to receive pension, you have to make contribution payments regularly. There are roughly two pension systems; Public Pension System operated by the government and Individual Pension Service provided by private companies. In this page we will talk about Public Pension System.

Who will join Public Pension System?

- Those who live in Japan aged between 20 and 59 will join the pension system. All residents in Japan including foreign residents must join the system.

Please explain National Pension System.

- National Pension System is called “Basic Pension”, which means everyone must join it. There are following three categories in the system;

①Category I insured persons

Who to join : Those who are aged between 20 and 59 who do not belong to Category II or Category III such as farmers, self-employed persons, students or un-employed persons

For example, those who own companies or shops belong to this category. In this category, people have to pay 16,610 yen of contribution per month. Contribution payments can be made by cash at banks, post offices or convenience stores. Automatic bank transmission or credit card are also available. You can also select “Advance payment”, by which you can get discounts. Advance payment using automatic bank transmission provides you the biggest discount.

②Category II insured persons

Who to join : Those who are employed to any organizations including public servants and company workers

Full-time workers who work at companies or factories which join Employee’s Pension Insurance System will belong to this category. Part time workers may also belong to this category if they work longer compared to the designated length of time in a week, and work at the working places longer than one year and earn more than the designated amount. (Students will not belong to this category.) Your company will make the insurance contribution payments on behalf of you while deducting half of the needed amount from your salary.

③Category III insured persons

Who to join : Those who are a dependent spouse of a Category II insured person and are aged between 20 and 59 (annual income less than 1.3 million yen)

People in this category do not need to make contribution payments.

Please explain the difference between National Pension System and Employee’s Pension Insurance system.

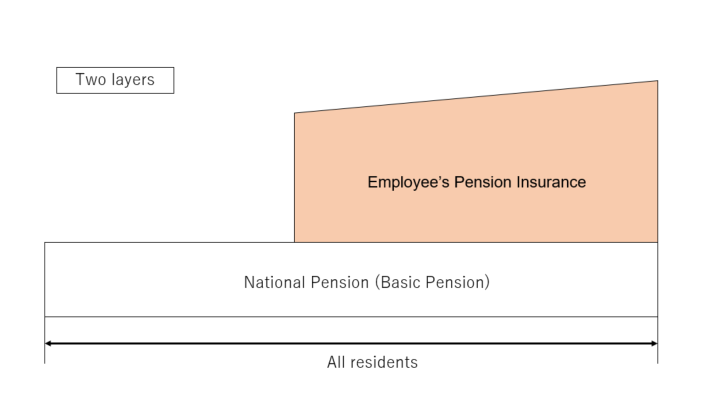

- Those who are aged between 20 and 59 must join National Pension (Basic Pension). Those who belong to Employee’s Pension Insurance will receive higher amount of pension in addition to the amount of public pension. In this reason Japanese pension system consists of two layers. Generally, those who belong to Employee’s Pension Insurance will receive higher amount of pension.

Please explain types of National Pension System.

- There are three types; Old-age Basic Pension, Disability Basic Pension and Survivors’ Basic Pension.

①Old-age Basic Pension

If you continue to make contribution payments for 10 years and more, you will be able to receive this pension after you become 65 years old. Longer period of time you make contribution payments, higher amount of pension you will receive. If you belong to National Pension System, you will receive “Old-age Basic Pension”. The amount will be 780,900 yen per year in the condition that you continuously make pay contribution payments for 40 years. (The amount will be deducted if there is any period of time you do not make contribution payments or there is any period of time that postponement is applied.) If you belong to Employee’s Pension Insurance System, you will receive “Old-age Employee’s Pension”. The amount of pension will be calculated based on your salary and length of time to make contribution payments, and your family members; whether you have a spouse and how many children you have.

②Disability Basic Pension

You will receive pension if you remain disabled after getting sick or injured. Those who belong to National Pension System will receive “Disability Basic Pension” and those who belong to Employee’s Pension will receive “Disability Employee’s Pension”. It is not necessarily that you continue to make contribution payments for 10 years and more in order to receive this pension. The amount of pension will be calculated based on the grade of disability and number of children starting from 780,900 yen (basic amount) per year. (780,900 yen * grade of disability +additional calculation based on number of children※) Disability Employee’s Pension will be calculated based on the grade of disability, salary, length of period of time to make contribution payments and whether you have a spouse.

※Additional calculation for number of children

First and Second child:224,700 yen/year, Third child and later children:74,900 yen/year

③Survivors’ Basic Pension

If a person who belong to pension system passed away, and if the person has a family to support financially, the family members will be able to receive pension. If the person who passed away belongs to National Pension System, the family member will receive “Survivors’ Basic Pension”, and if the person belongs to Employee’s Pension System, the family will receive “Survivors’ Employee’s Pension”. In the case of Survivors’ Basic Pension, her or his spouse who has children under 18 years old or her or his children under 18 years old can receive it. In the case of Survivors’ Employee’s Pension, her or his spouse, children, parents, grand children or grand parents can receive it. (There are some requirements.) In the case of Survivors’ Basic Pension, the amount of pension will be calculated based on the number of children starting from 780,900 yen (basic amount) per pear. (780,900 yen + additional calculation based on number of children※) Disability Employee’s Pension will be calculated based on salary and length of time to make contribution payments.

※Additional calculation for number of children

First and Second child:224,700 yen/year, Third child and later children:74,900 yen/year

How can I apply to pension system?

- The procedure of National Pension System can be done at a counter of National Pension System at a ward office where you made registration as a resident. The procedure of Employee’s Pension System will be done by a company where you are working at.

I have no money to pay contributions. What should I do?

- You may apply to exemption from contribution payments or postponement depending on your income. For “Exemption”, there are cases of full exemption and partial exemption. (75%, 50%, 25%) If you are a student, you can apply to postponement of contribution payments. In both cases, the amount of pension you will receive will be deducted.

I have paid contribution payments in Japan, but recently I moved back my home country. What should I do?

- If you pay contribution payments for 6 months and more, you can apply to Lump-sum Withdrawal Payments. The amount will be higher if you make contribution payments for longer period of time. The procedure should be done within two years after losing address in Japan.

I have belonged to pension system in my home country. Does it have any relation with pension system in Japan?

- There is a possibility that the length of time you have made contribution payments in your country and the length of time you make contribution payments in Japan can be combined and calculated. It will be possible if your county signs Social Security Agreement with Japan. 20 countries including the U.S., China, and South Korea signs it. For detail, please check the following link.

<<https://www.nenkin.go.jp/service/shaho-kyotei/20141125.html>>

I have worked at a company and have belonged to Employee’s Pension System, but I quit the job. What should I do?

- You have to stop belonging to Employee’s Pension System and newly apply to National Pension System. Japan Pension Service will send you a letter for the application. Please check it and fill out forms and submit them.

Comments

The types, conditions, amounts of pension you can belong or you can receive will depend on each situation. For detail, please consult with a person at a counter of National Pension System at ward office or Pension Office. For the matter of Employee’s Pension System, please ask your company.

For reference, this is a link to detail information at a Web page of Japan Pension Service.

Japan Pension Service

https://www.nenkin.go.jp/service/pamphlet/kaigai/kokunenseido.files/2English.pdf

- Please also refer to the following pages.

“Words used in Payment Slip (Kyuyo meisai)”

https://social-b.net/baiyu/en/payment-slip20020611en/

“Tax” https://social-b.net/baiyu/en/tax0730en/

“Local tax” https://social-b.net/baiyu/en/local-tax0730en/

- If you have further inquiries, please feel free to ask questions from the link below.

https://social-b.net/baiyu/en/question-box/